Summary

Pedersen’s tax reform legislation would, for the first time, eliminate a regressive utility tax for everyone and offset that water tax revenue with a local 2% capital gains excise tax.

Pedersen’s fiscally responsible tax reform legislation would, for the first time, eliminate a regressive tax for everyone and offset that water tax revenue with a local 2% capital gains excise tax.

SEATTLE – Councilmember Alex Pedersen (District 4 – Northeast Seattle) announced today a bold tax reform to make our system more fair for Seattle with legislation eliminating a regressive water tax for everyone and replacing it with a 2% local expansion of the State’s new progressive tax on high-end capital gains.

“Everyone knows the people of Seattle have suffered too long from one of the most regressive tax systems in the nation,” said Councilmember Pedersen, chair of City Council’s Transportation and Seattle Public Utilities Committee. “Because tax reform for tax fairness is overdue in Seattle, I am introducing legislation to eliminate our regressive and arbitrary tax on everyone’s drinking water and replacing it with a reasonable 2% capital gains excise tax on large, non-retirement financial gains to match the new State law. The top 1% can afford to pay this 2%. Adopting a more fair and progressive capital gains tax would ensure no one has to pay taxes for their drinking water in Seattle, making this the first time City Hall has proactively eliminated a regressive tax.”

Matching the new State law, this local tax would apply to only a very small number who gain more than $250,000 in a single year from the sale of assets, such as stocks or bonds, and it would exempt retirement savings and real estate transactions. Using zip code-level information gathered for the state-level capital gains excise tax, a local 2% could generate approximately $50 million annually, which would offset the amount City Hall’s General Fund takes from your water bills each year, so that this tax reform is essentially revenue-neutral.

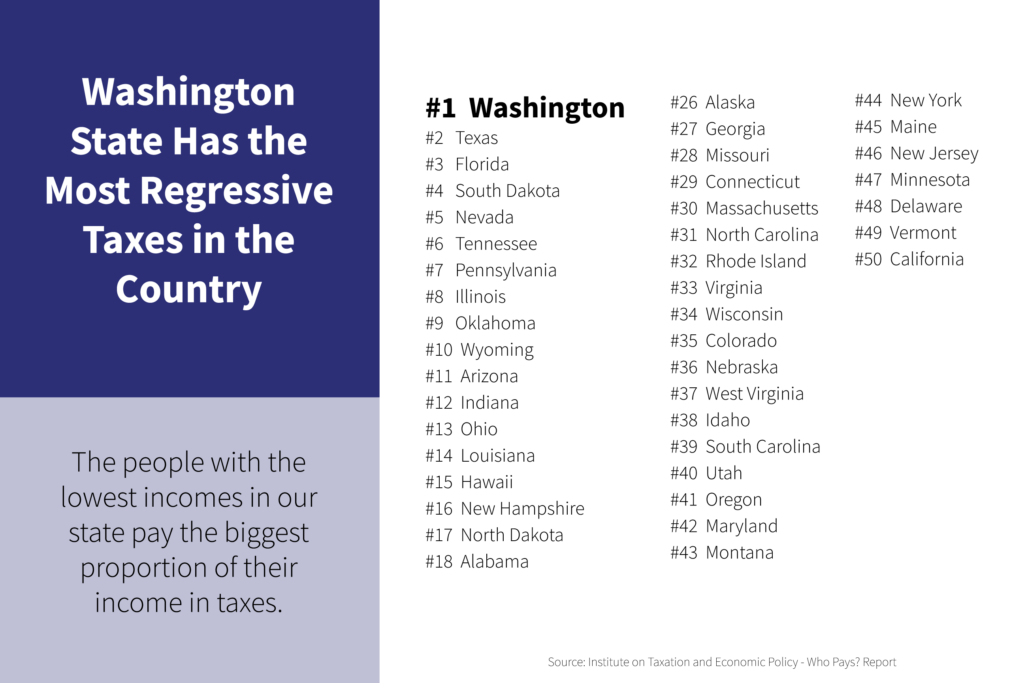

The Institute for Taxation and Economic Policy (ITEP) consistently ranks Washington State as one of the most unfair systems in the country, where lower income residents pay a much higher percentage of their household earnings for taxes and fees than wealthier residents.

Pedersen’s plan for Seattle tax reform would utilize the revenue from the capital gains tax to eliminate one of our most regressive forms of taxation: the utility tax on water. As our system currently stands, households and businesses are not only charged for the cost of the water from Seattle Public Utilities, but also taxed on that same water by City Hall at an arbitrary rate of 15.54%. The revenue from the regressive water tax flows into the city government’s General Fund, which supports various City-funded operations.

For a typical household in Seattle, eliminating the water tax is likely to save at least $100 per year.

Local small business owner, Molly Moon Neitzel of Molly Moon’s Ice Cream said, “As a small business owner who sees her employees struggling with regressive expenses, I support extending the progressive capital gains excise tax to Seattle to eliminate the city’s tax on everyone’s water bills. Councilmember Pedersen’s legislative proposal is an important part of the solution, as we work toward a more fair economic system.”

John Burbank, founder and retired Executive Director of the Economic Opportunity Institute think tank, said, “Introducing a progressive tax to sunset a regressive tax on everyone is a welcome and elegant step forward in addressing economic inequities in Seattle. Lower income households that pay a greater proportion of their income for their utility bills, including many seniors on fixed incomes, will benefit from eliminating the water tax. I appreciate Councilmember Pedersen for swiftly recognizing this opportunity for greater fairness by leveraging the new State law to benefit the people of Seattle with meaningful tax reform.”

Pedersen’s legislation needs to be adopted before the end of 2023 for Seattle to have authority throughout 2024 to track and tax the high-end, annual capital gains within the city limits and then eliminate the regressive water tax for everyone at the end of 2024. Moreover, City Hall has already endorsed for 2024 its $7.4 billion budget (of which $1.6 billion is for the General Fund), and it will require all of 2024 to quantify the capital gains taxes to be collected to offset the water tax. Put simply, Pedersen’s revenue-neutral tax reform legislation must be adopted in 2023 to impact 2025. Not adopting the legislation in 2023 would essentially signify that City Hall leaders remain okay charging its residents the unnecessary, regressive tax on drinking water.

Expanding the State’s new excise tax for high-end ($250,000 or more) capital gains that exempt retirement funds and real estate transactions so that it eliminates a regressive tax paid by everyone in Seattle is prudent and fiscally responsible, considering widespread concern about our city government’s growing budgets. Nearly 60% of Seattle voters said their taxes are too high and nearly two-thirds said they don’t trust City Hall to spend their tax dollars responsibly, according to a survey conducted by EMC Research in April 2023. A revenue-neutral tax reform that, for the first time, proactively eliminates a regressive tax can help to rebuild trust with the majority of residents who are skeptical of financial proposals from City Hall.

As chair of the City Council committee overseeing Seattle Public Utilities, Councilmember Pedersen held a discussion on June 6, 2023 to highlight this regressive taxation on utilities. He also introduced the concept of using the progressive excise tax to provide relief for regressive taxes in his widely distributed newsletters from April and May 2023.

Links to more information:

- View a PDF of the visuals

- For a link to Councilmember Pedersen’s proposed legislation:

- Repeal of the regressive water tax: CLICK HERE and HERE.

- Application of the progressive capital gains excise tax: CLICK HERE and HERE.

- For Councilmember Pedersen’s blog post, CLICK HERE or go to: https://pedersen.seattle.gov/

- For June 6, 2023 presentation on “utility taxes” from our City Council Central Staff, CLICK HERE or go to: https://seattle.legistar.com/View.ashx?M=F&ID=12060070&GUID=06C1DFD8-325F-4F52-96A9-80B7E32021D0

- For utility tax information from the non-partisan Municipal Research Services Center, CLICK HERE or go to: https://mrsc.org/explore-topics/finance/revenues/utility-tax

- For a description of the non-retirement capital gains tax from the State Department of Revenue, CLICK HERE or go to: https://dor.wa.gov/taxes-rates/other-taxes/capital-gains-tax (The City would mirror the methodology of the State.)

- For the Seattle Times May 26, 2023 article on the capital gains amounts, CLICK HERE or go to: https://www.seattletimes.com/seattle-news/politics/was-new-capital-gains-tax-brings-in-849-million-so-far-much-more-than-expected/ For the related May 27, 2023 column by Danny Westneat, CLICK HERE or go to: https://www.seattletimes.com/seattle-news/politics/was-wealthiest-are-richer-than-even-the-tax-collectors-guessed/

# # #