On Monday, July 6, 2020, your Seattle City Council voted 7-2 to approve a new tax on large Seattle employers (Council Bill 119810). This new tax will be in addition to the Business & Occupation (B&O) taxes, property taxes, sales taxes, and business license fees paid by Seattle employers. This new tax must be paid by any Seattle organization (for-profits and most nonprofits) with payroll of $7 million or more, with the tax rates applied only to salaries above $150,000.

I represent a wonderful City Council district blessed with a diversity of views on issues — and that makes many votes difficult as I hear passionate pleas from many angles. I’d like to thank the thousands of constituents who took the time to contact me about this important budget matter. After surveying and listening to constituents in District 4, I decided to repeat at the July 6 City Council meeting my “No” vote from the July 1 Budget Committee. These were not easy votes for me. The purpose of this post is to explain my votes.

SUPPORTING COVID RELIEF: For some context, please note I am likely to vote IN FAVOR of the short-term, COVID relief package (Council Bill 119812) which will tap our city government’s Emergency Fund and Revenue Stabilization Fund at amounts higher than proposed by Mayor Durkan. In fact, I have consistently voted in favor of relief packages and regulatory changes to help those impacted most by the COVID crisis. The Mosqueda Tax, however, is a long-term (20-year) policy that required additional considerations.

BETTER THAN SAWANT TAX: First, let me say that Councilmember Mosqueda’s “JumpStart” Tax is superior to Councilmember Sawant’s “Amazon Tax.” As you may recall, I strongly critiqued Councilmember Sawant’s tax proposal in April. Thankfully, my Council colleagues agreed to take a different path. Sawant’s Tax would have taxed nearly 800 Seattle employers and would have oddly made available much of the money for higher income households (up to 100% of area median income). Councilmember Mosqueda is commended for targeting only higher salaries at fewer employers and for proposing to spend most of the funds on the lowest income households.

REASONS FOR VOTING NO:

Even though Councilmember Mosqueda’s Tax is better than Councilmember Sawant’s Tax — and I understand the rationale for most of my colleagues voting Yes — the Mosqueda Tax did not earn my Yes vote for the following reasons:

- Penalizes only Seattle employers; it’s not a regional solution: The JumpStart Tax targets Seattle employers only. I’m concerned about imposing a new tax just on Seattle employers during a deep recession when employers are shedding jobs. If we want our employers to stay in Seattle and rehire as many workers as possible, why would we impose yet another financial and administrative burden on them? I’m concerned employers will leave Seattle, fed up with a slew of increasingly anti-business laws from City Hall officials with little to no business experience. Even though this tax targets larger employers, the small businesses that support them could be negatively impacted if large business within the economic ecosystem depart. While better than the Sawant Tax, I’m concerned this new JumpStart tax could still become the “Bellevue Relocation Act.”

- Nonprofits must pay the new tax: Unfortunately, my colleagues at the July 1 Budget Committee rejected my amendment to exempt nonprofit organizations from the new tax. I’m concerned the temporary exemption for nonprofit health providers approved July 6 is too strict and will end up taxing several healthcare providers when we should want those organizations to survive and thrive so they can help our residents impacted by COVID.

- Tax lasts for decades: Unfortunately, my colleagues conceded to a demand by Councilmember Sawant to remove a sensible 10-year “sunset” provision from the original bill. (I had introduced an amendment for a shorter 4-year sunset so that a future City Council could more easily re-examine the tax after COVID and after the recession.) The provision to “monitor proposals” from the State or County in case they enact other business taxes was too weak and unenforceable to offset the removal of the sunset. As a compromise, the City Council today (July 6) passed by a slim 5 to 4 vote an amendment to insert a 20-year sunset (when the tax can be more easily reviewed, renewed, increased/decreased or canceled if other progressive sources are available).

- Spending plan is vague. City Council was put in the position of having to enact this new tax without knowing the full details of how it would spend the money because it voted to strip out the details (Council Bill 119811). I’m concerned there is a high risk the money will not be spent effectively or will be used to sustain the exorbitant salaries being paid to many city government workers – to sustain steep salaries at City Hall, rather than city services to the public. I appreciate my colleagues passing my amendment to require additional focus on “effectiveness” and “evaluation” and to reduce the potential conflicts of interest on the new “Oversight Committee” that will monitor the new tax. Nevertheless, without the spending plan details, I’m concerned this is “Tax First, Ask Questions Later.”

- Under-estimating the dollars. It’s not clear how much money the Mosqueda Tax will raise. Depending on how we interpret the conflicting estimates and financial assumptions, the $200 million annual prediction is probably low. In other words, the city government will likely extract more money than anticipated without a clear plan on how to spend it and without a sunset date to revisit the tax. That’s not fiscally responsible.

- Does Not Give Voters a Choice. The Mosqueda Tax is 4 times larger than the Head Tax the previous City Council reversed just two year ago. Sending the tax and spend proposal to the November ballot would have provided more time to see how the economy is recovering and for our State government to pass a better statewide or regional measure for revenue. Unfortunately, a majority of my colleagues rejected the amendment sponsored by me and Councilmember Debora Juarez to let the voters decide as they do for most taxes.

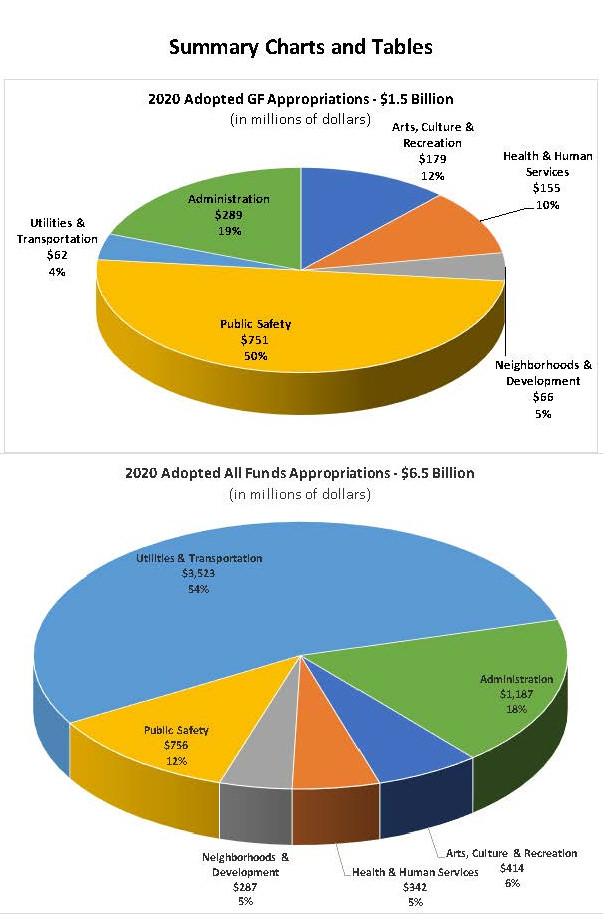

- Did Not Look for Costs Savings First: If our City Council spent as much time investigating how our city government spends its existing $6.5 billion as it has pursuing new taxes, I believe we would have a more balanced, fiscally responsible and sustainable approach to delivering effective government. I see common ground emerging in how we look into our police budget – the large salaries there are also in other city departments, as noted in the recent investigation by Forbes. The lessons learned from the new “inquest” into the police budget (by Councilmembers who approved that same budget in November 2019) could be applied to other city departments so that we expand social services, instead of government salaries. That’s not “austerity,” that’s Sustainability. I’d also like to join my colleagues in pushing our Governor and State Legislature to pass progressive tax tools that our region can use. But, with Seattle going on its own with a new business tax, it’s not clear to me why other King County cities would want to impose their own new taxes, when instead they could simply attract the businesses away from the city of Seattle.

SUPPORT PROGRESSIVE TAXES: I’d like to join my colleagues in pushing our Governor and State Legislature to pass progressive tax tools that our region can use, similar to House Bill 2907 that almost passed earlier this year. I support progressive taxes, we need progressive taxes — and we need our State government to act.

HOPE: For the sake of our city, I hope my concerns about this new tax are just concerns and do not occur. I’ll look forward to working with my colleagues and the Mayor to create a sustainable tax an spend path as part of our Fall budget discussions for the 2021 budget. I also hope that the general public does not see division or dispute with the 7 to 2 vote, but rather the debate and discussion required for a healthy legislative process here at your Seattle City Council.

BACKGROUND:

- Our city government budget currently spends $1.7 billion for its flexible General Fund and $6.5 billion in total (including for infrastructure / transportation projects, Seattle City Light, and Seattle Public Utilities).

- Our city continues to face significant challenges such as homelessness and the COVID pandemic. Federal and State aid, including unemployment insurance, have helped. Nevertheless, the city government faces a temporary budget deficit due to increased costs and decreased tax revenues / economic activity during COVID.

- The state government has a notoriously regressive tax structure that limits new options to raise city revenue. Thus far, all efforts to correct this in Olympia have failed.

- Some City Councilmembers proposed new payroll taxes on large Seattle employers. Among these were (A) Kshama Sawant ($500 million per year with no end date) and (B) Teresa Mosqueda ($200 million per year for 10 years). For context, the 2018 Head Tax that the previous City Council approved — and then reversed after public backlash — would have raised “only” $50 million. The City Council approved the Mosqueda Tax on Monday, July 6.

- For the legislation and all the amendments offered for Councilmember Mosqueda’s proposal, CLICK HERE for our July 1 Budget Committee agenda.

# # #