Capital Gains Tax would build housing, support homelessness services

Seattle City Councilmember Andrew J. Lewis (District 7, Magnolia to Pioneer Square) will introduce progressive revenue legislation, a capital gains tax that would create resources to build affordable and permanent supportive housing, and fund additional homeless services, on Friday (June 19).

Council Central Staff estimates a 1 percent capital gains tax on stocks and bonds when sold for profit is expected to raise roughly $37 million per year.

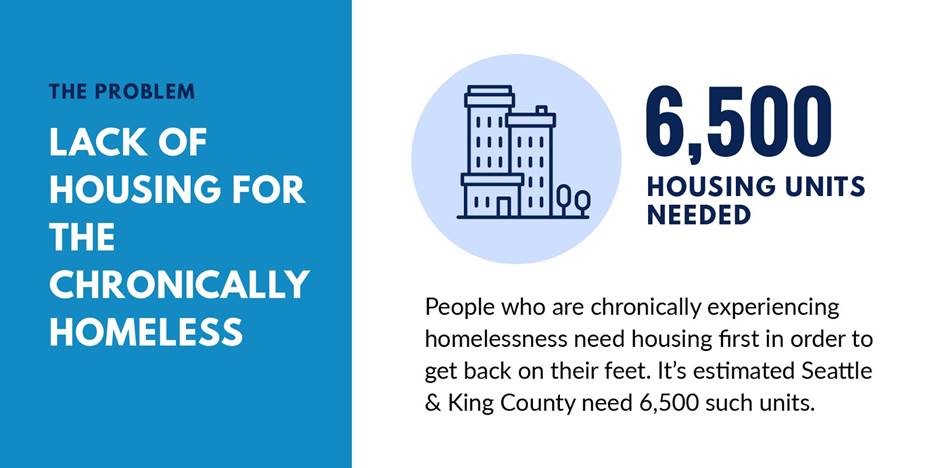

“We know the solution to meet the scale of our homelessness and affordable housing crisis – it’s providing more housing. Specifically, we need to invest in permanent supportive housing with wraparound services, so our homeless neighbors can stabilize, create community, and ultimately heal,” Lewis said. “I joined the Third Door Coalition, which estimates our region will need $1.6 billion over the next five years to build 6,500 units to make an impact on our homelessness crisis. Our nonprofit and private sectors cannot go it alone. Our government must raise progressive revenue in order to adequately address this crisis.”

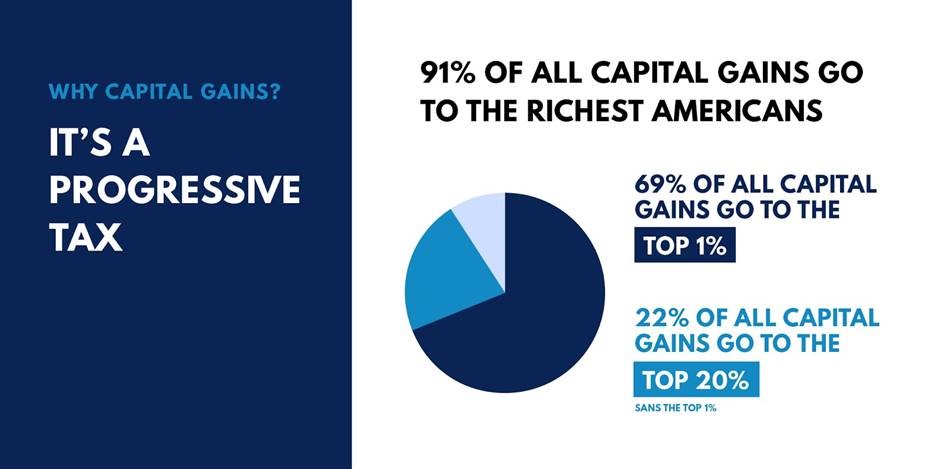

The capital gains tax will not apply to retirement accounts, home or commercial real estate sales, or investments that lose money. It is estimated 70 percent of Seattlites wouldn’t pay the tax. According to Brookings, Sixty-nine percent of all capital gains go to the top 1 percent of richest Americans .

Lewis will introduce the legislation, recognizing it’s one way for the City of Seattle to raise revenue without further adding to a regressive tax system.

“I will pay this tax,” Lewis said. “And I will be happy to do it. If I’m fortunate enough to make $500 on the stock market this year, the least I can do is give $5 to the City to house and support people. I wish it could be more.”

Councilmember Lewis intends to introduce the legislation on June 22, 2020. It’s expected the Council will consider the legislation as part of its summer budget committee.